Boosting sales and customer satisfaction in the electronics industry with deferred payments

The electronics industry is a thriving market, valued at over 3.17 trillion euros in 2022. With rapid technological advancements and increasing demand for consumer electronics, businesses in this sector strive to remain competitive by capturing and maintaining market share.

Terms.Tech has introduced payment terms as a strategic solution for both retailers and wholesalers in the electronics industry.

Our deferred payment solution lets you:

- Attract more customers

- Increase sales volumes

- Manage inventory more effectively and ensure a continuous supply of the latest electronic gadgets and components.

- Integrate the payment solution for online, telesales or in-person sales channels

Working together with Terms.Tech means we take care of all risks around non-payment and fraud while you and your clients benefit from:

- Improved cash flow

- Higher conversion rates = profitability

- Happy and loyal customers

5 reasons to choose Terms.Tech as your payment terms provider

Enhance customer experience

B2B customers love to pay for goods with credit. Offer Terms.Tech’s payment terms at your checkout and watch your conversion rates increase while you attract new customers. Flexible. Fast. Easy to use.

Fast and consistent cash flow

Your cash flow and working capital are key to a successful business. We pay you up front and the buyer pays us back via payment terms up to 90 days or in instalments. It’s a win-win for you and your customers.

Fine-tuned credit check

Give your business the reputation it deserves. With our in-house-developed eligibility assessment tool, you can rest assured that we extend payment terms only to those with a good credit rating. Not only is our process lightning fast, it takes the pressure off of you to run your own checks.

Risk-free terms

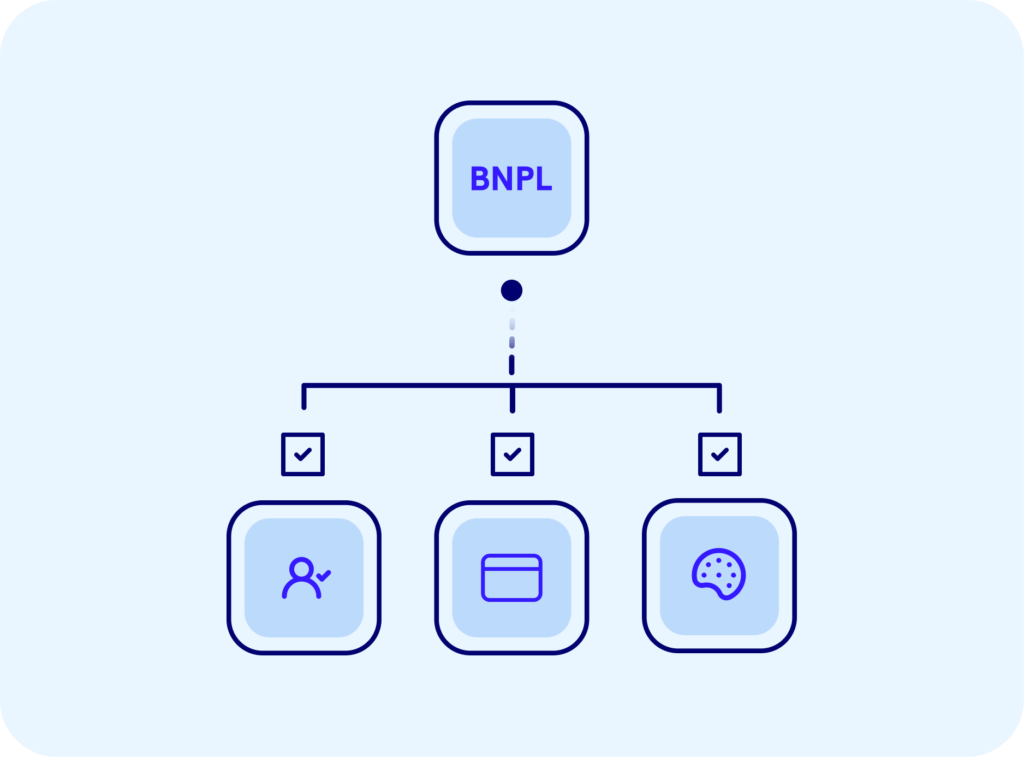

Any non-payments? That’s not your problem anymore! Our Buy Now, Pay Later solution is completely risk-free for you. Any payment defaults due to fraud or non-payment are on us. This way you can reduce your risk while focusing on what you do best. Terms.Tech helps you to build your business wisely and safely.

Ready to grow your business with us?

Sell more and increase your revenues with our fully customised Buy Now, Pay Later solution